When adding Klarna Payments to your site, you need to consider

- Data protection and data sharing aspects

- Required wording on order confirmation button to ensure legal obligation to pay

- T&C information

Please seek legal advice to ensure compliance with applicable regulations.

Please be aware that Klarna Payments may only be utilized at stores (both online and in-store) that have received prior approval from Klarna. Usage of Klarna Payments in any store not authorized by Klarna could result in an obligation to repay any claims arising from such unauthorized use.

National and EU rules such as the GDPR sets certain limits to how and when you may share customer identifying information with Klarna.

If you share personal data with Klarna you need to explain this in your privacy notice and link to Klarna’s privacy notice there. Below is an example of what that could look like in your existing privacy notice (the specific data categories transferred to be added, and text to be translated into your local language):

“In order to offer you Klarna’s payment methods, we might in the checkout pass your personal data in the form of contact and order details to Klarna, in order for Klarna to assess whether you qualify for their payment methods and to tailor those payment methods for you. Your personal data transferred is processed in line with Klarna’s own privacy notice.”

A court ruling (case C-249-21) has established a principle regarding what copy needs to be displayed on the order confirmation button in retailers' checkout in order to legally obligate the consumer to pay. It is not enough to just state “order”; it needs to combine an order with the obligation to pay, similar to wording like “order and pay”. It is the responsibility of each individual online retailer who has integrated Klarna Payments to ensure compliance with the above-mentioned principle since the retailer controls the order confirmation button. More information can be found in KP Best Practices - payment widget.

Ensure that your terms and conditions reflect your cooperation with Klarna, and that you comply with applicable laws.

As a merchant using Klarna to transact with your customers, it is crucial to meet, among other things, legal requirements on the merchant's website to ensure transparency and compliance with applicable consumer protection laws.

Before a customer completes its purchase on your website, you must present the following information in a clear and easily accessible manner on your website. Please note that it is not sufficient to require customers to first contact you to receive this information, nor delay providing it until after the transaction is completed.

Merchant Identity and Contact Information

- Display the merchant entity’s registered legal name, registered business address, and active customer service email address and phone number.

- Also display your unique corporate or organisational number in the applicable trade or company register in the specific EU member state your company is registered.

Product or Service Description

- Provide clear, detailed, and accurate descriptions of products or services, including essential characteristics, to ensure customer understanding. If you choose to include images or videos, they must also reflect a clear and honest representation of the products.

Total Price and Payment Information

- Clearly display the total price, including taxes, fees, and any additional charges (such as delivery or customs fees), and outline payment terms and available payment methods.

Delivery and Performance Details

- Specify estimated delivery times, shipping methods, and any geographical restrictions. For services, outline the timeline for service completion.

Right of Withdrawal

- Inform customers of their right to withdraw within 14 days, including instructions on how to exercise this right, including the timeframe. For goods this means 14 days from the date of receipt, for services 14 days after the day the contract was agreed.

- Inform your customers of the method of communication to exercise their right of withdrawal (email, website form, or written notice)

- Clearly state if the customer is responsible for the return shipping costs if they choose to withdraw.

Return and Refund Policy

- Include a clear policy for returns, refunds, and exchanges, specifying conditions, timelines, and any associated costs.

- If the goods or services turn out to be faulty or do not look or work as advertised, you must offer remedies to the customer, such as repair, replacement, or refund. Clearly state in your return policy that you will cover return shipping costs for incorrect or faulty items.

- Clearly outline the types of products eligible for return, any exceptions (for example, perishable goods, digital downloads, custom-made items), and any specific conditions required (for example, in original packaging, with tags attached).

- Describe the steps for initiating a return, such as contacting customer support, completing an online return form, or including a printed return slip with the item. Provide return shipping instructions, including address or instructions for any return pick-up services offered.

Customer Support and Dispute Resolution

- Describe the process for resolving disputes directly through the merchant, such as submitting a complaint or request via email or an online form, and outline the expected response timeline. Provide contact information for customer support and outline any internal or third-party dispute resolution options.

Digital Content or Subscription Details (if applicable)

- For digital services, specify any limitations on functionality, compatibility, and duration of access. For contracts of fixed duration or subscriptions, specify the length and conditions for renewal and termination.

Legal Rights and Warranties

- Mention statutory warranty rights and any additional commercial guarantees if provided.

Customer Reviews and Testimonials

- Ensure all customer reviews and testimonials on your website are genuine and transparent by:

- not engaging in buying, selling, writing, or publishing fake reviews,

- not offering incentives for positive reviews,

- not suppressing or censoring negative reviews,

- disclosing any insider relationships within reviews,

- avoiding the creation of company-controlled review sites that falsely appear independent, and

- refraining from trading in fake social media influence indicators.

Important Notice:

Non-compliance with these requirements may significantly impact the resolution of any disputes. Adhering to the guidelines listed above is essential for maintaining trust and accountability in your dealings with customers and ensuring a favorable outcome in dispute scenarios.

Klarna’s Buyers Protection Policy

Do not use Klarna’s Buyer’s Protection Policy in any promotional materials or website copy as an endorsement of the quality of your goods or your store. It is intended to reassure buyers about the purchase process, not to imply any endorsement of product quality or store reputation.

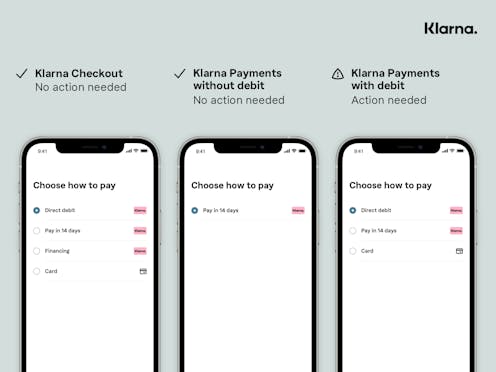

Klarna Checkout (KCO): No action required.

Klarna will take care of all the logic to ensure debit payment options are shown first.

Klarna Payments (KP) with no debit options: No action required.

You are only required to make sure a debit option is placed as the first option if you offer it as a payment method.

Klarna Payment (KP) with debit options: Action required.

As a merchant, you are in control of the order in which payment methods are organized inside your checkout and will need to take steps to comply with the new law.

Continue reading for more details on how KCO will be presented, and what actions we recommend if you have KP with debit options.

What the new law means

New legislation (Regeringens proposition) adopted by the Swedish Parliament will take effect on 1 July 2020, and will only be applicable to Sweden. The law sets requirements on the presentation of payment methods in online checkouts, enforcing debit payment options to be displayed before any credit payment options, if both are available.

Obligations in the new regulation apply to any parties who present or process payment methods. This includes: merchants, partners, and Payment Service Providers (PSP) like banks. To navigate the new changes, we’ve published guidelines, to help our merchants and partners to ensure compliance with the legal requirements.

What does this mean for me as a merchant?

The impact for you as a merchant will depend on what payment methods you offer and what checkout solution you use. The new legislation does not require merchants to provide debit payment methods, but does regulate how to present them in an online checkout if you do.

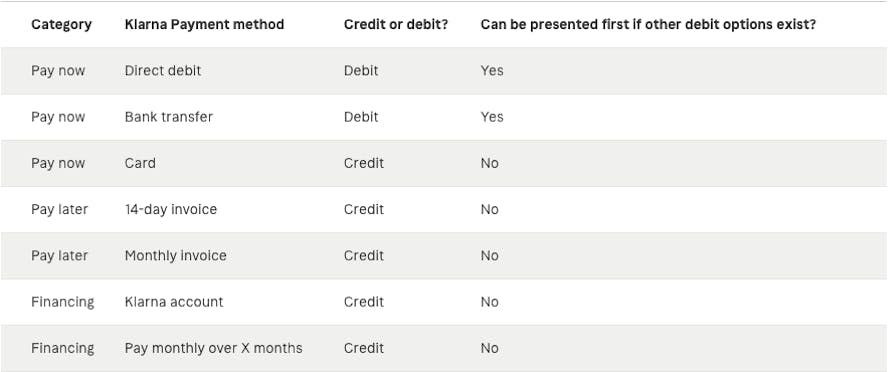

Below is an overview of Klarna payment methods, and how each categorizes in terms of credit or debit options.

What do I need to do to be prepared?

Merchants with Klarna Checkout (KCO v2 & v3)

No action needed. Klarna will update the current KCO solution for the Swedish market to make sure that the new legal requirements are followed. You will notice that debit payment methods such as Direct Debit, (when available), will be presented as the first option in your checkout.

Merchants with Klarna Payments (KP)

If you offer Klarna Payments in your checkout, Klarna cannot control the order or logic in which the payment methods are presented. Therefore, as a merchant you are solely responsible to ensure your checkout is compliant and lawful according to the new legislation before it enters into force (1 July 2020).

If you have Klarna Payments (KP) and multiple Klarna payment methods within the same widget then we will manage the logic of sorting these. If a debit payment option exists then that will be displayed first. Credit payment methods that include interest rate will always be displayed as the last option if others exist. If the multiple Klarna payment methods are placed in different widgets then we cannot control in what order they will be sorted.

Klarna will discontinue support of Klarna Payment Methods (KPM) as of September 2020. Action recommended.

Klarna will no longer be supporting KPM as of September 2020. For automatic updates (including legal compliance), we recommend all merchants move to Klarna Checkout (KCO) or Klarna Payments (KP). With KCO, Klarna will handle the sorting of payment methods for you. To migrate to KCO, you can use the self service flow that is available in the merchants portal (link). Please reach out to your Klarna account manager to get more information about pricing and how to transfer to Klarna Checkout or Klarna Payments.

Så påverkas du av den nya kreditlagen

Sveriges riksdag har tidigare i år beslutat om en ny kreditlag. Den innebär i korthet att om det finns både ett kredit- och ett direktbetalningsalternativ i kassan så får inte kreditalternativet visas först eller redan vara ifyllt. Lagen träder i kraft den första juli 2020.

Här är vad du behöver veta om du har följande betalnings- och kassalternativ:

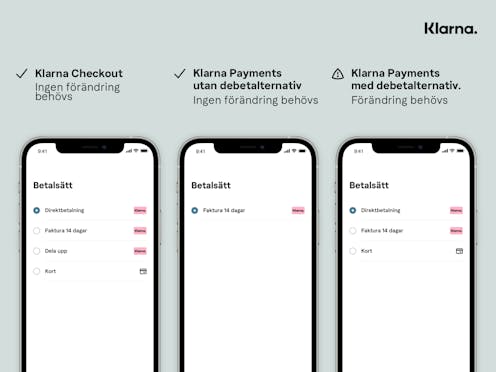

Klarna Checkout (KCO): Du behöver inte vidta några åtgärder.

Klarna kommer att hantera förändringen och se till att ett direktbetalningsalternativ visas först om ett sådant finns.

Klarna Payments (KP) utan något direktbetalningsalternativ. Du behöver inte vidta några åtgärder.

Du måste bara se till att ett direktbetalningsalternativ är det första alternativet om du erbjuder det som betalningsmetod.

Klarna Payment (KP) med ett direktbetalningsalternativ: Du måste vidta åtgärder.

Som e-handlare med Klarna Payment (KP) har du kontroll över ordningen på betalningsmetoderna som du har i din kassa och kommer därför att behöva vidta åtgärder för att följa den nya lagen.

Fortsätt läsa för mer information om hur KCO kommer att presenteras och vilka åtgärder vi rekommenderar för dig som har KP med direktbetalningsalternativ.

Vad den nya lagen innebär

Den nya kreditlagen som Sveriges riksdag har antagit (Regeringens proposition) kommer att träda i kraft den första juli 2020 och kommer endast att tillämpas i Sverige. Lagen ställer krav på hur olika betalningsmetoder presenteras i kassan, och den tvingar e-handlare att visa ett direktbetalningsalternativ före kreditalternativ, om båda alternativen finns tillgängliga i kassan.

Skyldigheterna i den nya lagen gäller alla parter som presenterar eller behandlar betalningsmetoder. Detta inkluderar: e-handlare, partners och betalningstjänstleverantörer (PSP) såsom banker. För att kunna navigera i ändringarna har vi skapat riktlinjer för att hjälpa våra e-handlare och partners att anpassa sig så att de nya lagliga kraven uppfylls.

Vad innebär det här för mig som handlare?

Exakt hur du påverkas beror på vilka betalningsmetoder som du erbjuder och vilken kassalösning som du har valt. Den nya lagen kräver inte att en handlare måste erbjuda ett direktbetalningsalternativ, utan styr hur betalningsalternativen presenteras i kassan.

Nedan finns en översikt över Klarna betalningsmetoder, och hur de kategoriseras i termer av kredit- eller direktbetalningsalternativ.

Vad behöver jag förbereda?

Handlare med Klarna Checkout (KCO v2 & v3)

Ingen åtgärd behövs. Klarna kommer att uppdatera den nuvarande KCO-lösningen för den svenska marknaden och säkerställa att de nya lagkraven följs. Ni kommer att märka att direktbetalningsalternativ, såsom Direktbetalning (när tillgängligt), kommer att presenteras som det första betalningsalternativet i din kassa.

Handlare med Klarna Payments (KP)

Om ni erbjuder Klarna Payments i er kassa så kan inte Klarna kontrollera i vilken ordning betalningsalterntiven presenteras. Det innebär att det är den enskilda handlaren som är ensam ansvarig för att se till att er kassa är kompatibel och följer den nya lagstiftningen innan den träder i kraft (1 juli 2020).

Om ni har Klarna Payments (KP) och flertalet betalningsmetoder via Klarna inom samma modul så kommer Klarna att sortera dessa. Om det finns ett direktbetalningsalternativ så kommer det att presenteras först. Kreditalternativ som inkluderar ränta kommer alltid att att presenteras sist om det finns andra val tillgängliga. Om flera betalningssätt med Klarna är placerade i olika moduler kan Klarna ej kontrollera i vilken ordning de presenteras.

Klarna kommer att sluta stödja Klarna betalningsmetoder (KPM) från och med september 2020. Åtgärd rekommenderas.

Klarna kommer inte längre att stödja KPM från och med september 2020. För att få automatiska uppdateringar (inklusive juridisk efterlevnad) rekommenderar vi att alla handlare migrerar till Klarna Checkout (KCO) eller Klarna Payments (KP). Med KCO kommer Klarna att hantera sorteringen av betalningsmetoder åt dig. För att migrera till KCO kan du använda självbetjäningsflödet som finns tillgängligt i portalen för handlare (länk). Prata gärna med din kontakt på Klarna för att få mer information om priser och hur du flyttar över till Klarna Checkout eller Klarna Payments.